The best small business accounting tools we’ve tested can help keep your company in the black. According to the IRS, the member will pay taxes for the LLC on personal income taxes using the 1040 tax return. Limited liability companies with a single owner or member accounting llc get taxed by the IRS as sole proprietorships. Financially and legally, an LLC is a separate business entity, which means business transactions should never mix with personal ones. Separate business accounts are the first step toward sound financial reporting.

The Best Accounting Software for Small Businesses in 2024

Therefore, setting up an LLC is a great way to manage the finances of a business and offers many benefits. Also, to manage its accounting for LLC the business can decide to either hire or consult with a professional https://www.bookstime.com/articles/work-in-process business accountant. A trained business accountant can advise the business on the appropriate legal structure for LLC accounting, tax-related obligations, and financial strategy and oversee financial reporting.

Organizing financial transactions

Sage 50 Accounting—also sometimes known as Sage accounting or Sage business cloud accounting—is a massive small business accounting application that’s designed for desktop use. It’s the most comprehensive accounting program we review, and it does more than what many small businesses need. The software offers built-in online connections that support some remote work since it integrates with Microsoft 365 Business.

Basics of LLC Accounting

When a person becomes a member, they will make a property or cash contribution (known as a capital contribution) to the LLC. Our dedication to hard work has earned the respect of the business and financial community in and around New York. Our Visual Tutorials are perfect for people who get overwhelmed studying jargon-filled accounting textbooks. Follow along step-by-step and we’ll explain the most important accounting topics in a more intuitive away. LLCs, like any other business, need an accounting foundation to continue running smoothly. FICA requires LLCs to pay self-employment taxes and contributions toward Medicare and Social Security.

We specialize in providing all accounting needs and services for small businesses. This includes small business bookkeeping services, accounting and tax services, and CPA services. Our outsourced accounting services help our small business clients cut costs, save time, and improve profits. Our accounting team practices a very ethical accounting system that is proven to help small businesses grow. Ohana Accounting LLC is the partner small business owners count on for accurate accounting services, smart bookkeeping solutions, and valuable tax strategies.

- Firstly, an LLC needs to have separate bank accounts for business transactions.

- You can use accounting to track cash flow and quantify your company’s financial health.

- Depending on how long your business has been operating, getting started with a small business accounting service can take anywhere from five minutes to several hours after signing up for an account.

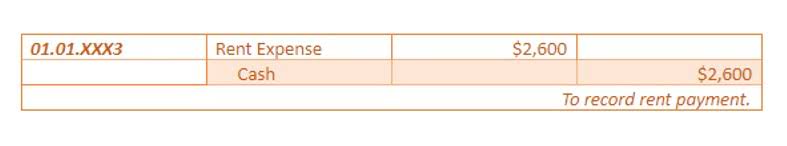

- For example, if a client was billed in June and the payment was received in August, the cash basis would record income for August, and the accrual basis would record income for June.

- These include a checking account for daily expenses, payroll, and other operational costs.

- As an LLC owner, you’ll have to attach a Schedule C for reporting business income and a Schedule SE for paying self-employment tax.

For instance, the revenue account records all income generated by the company while the expense account tracks various costs incurred during operations. However, LLCs with multiple owners that decide to go this route are essentially taxed twice. The LLC pays the 21% corporate tax, and each shareholder pays income tax on their dividends at capital gains rates, which can also be 20+%.

On the other hand, in a multi-member LLC, members may opt to take guaranteed payments or salaries. This distinction is crucial for managing employee payroll efficiently within the LLC. The IRS’s website is always the best place to find the latest and most detailed information regarding LLC taxation. With flexibility and independence also comes responsibility—particularly when it comes to your LLC accounting.